A new section 87A has been introduced in the Budget 2013-14 under Income Tax Act, 1961, which is applicable from 1st April, 2014, wherein an additional relief upto Rs.2,000 has been provided to assessees whose…

DUE DATE OF Income Tax Return Filing 2013…

A fresh breath has been pumped in to the heart of Tax payers who were facing difficulty in filing their return online or have not yet filed their returns, as the government on Wednesday extended…

E-Filing Income Tax Return ITR

Process Of e-filing Income Tax Return ITR What Is e-Filing? The process of electronically filing Income Tax Returns/Forms through the Internet is known as e-filing. E-Filing Returns and Forms mandatory for: Individual/HUF, having total Income…

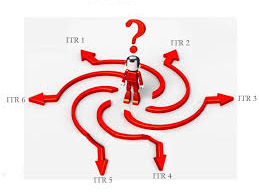

How to Select Income Tax Return ITR

Income tax return ITR has undergone changes from being only 1 form named ‘Saral’ to 8 ITR forms. It has become easy for professional but confusing for general users. Lot of tutorials and information material…